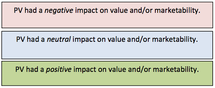

| While there have been many studies that document the value of solar systems at time of sale, there has been little analysis to date on the impact of 3rd party owned solar system (leases or PPA) on home valuation or marketability. Given the enormous growth in 3rd party financed solar market, which currently represents more than 75% of the market in California, and is increasing market share in just about every viable solar market, this question is of great importance. In May of 2013 a report entitled The Impact of Photovoltaic Systems on Market Value and Marketability, was released by the Colorado Energy Office. The study, which is far from conclusive, looked at case studies of 30 single‐family homes in the north and northwest Denver metro area and the impact of solar on the roof at time of sale. In terms of the direct impact on values, they found that solar systems that are owned did in fact have a positive impact on home value, adding between $1,400 to $2,600 per kW on the roof. However, the qualitative part of this study turned up some interesting and somewhat concerning trends when one looks at the differences between 3rd party owned solar (Leases and PPAs) versus owned systems. First off, there has long been an economic argument that given the falling cost of solar, and the zero upfront nature of third party leasing, truthfully a "solar ready" house should be more valuable than one that already has a 3rd party owned system on it, as there is no upfront costs to putting a system on, and the price keeps dropping. However consumers are not always rational economic actors, so the fact that people values solar was not a complete surprise. When one reads the qualitative results of this report, and looks at the effect of Leased vs. Owned solar systems on the value of houses and transactional friction, there appears to be a rather clear trend that 3rd party owned systems are not having the same positive impact on home values, and in some cases are adding significant friction. Of the 39 systems studied, 72% were owned systems, and overall, 59% of the time solar was rated as adding market value or marketability to the transaction. However, of the 22 homes where solar systems were rated as a positive, only two (2) of the homes were leased, while of the 14 neutral impacts six (6) were Leased, and in the three (3) cases of negative impacts on the transaction 100% were Leased systems. I would caveat all of these conclusions and concerns as extremely preliminary. This is a small dataset and these are qualitative results. But when you read the comments in the table on the right there is a clear difference in the feedback when you compare those systems that are owned with those that were leased. There is a lot more to this study, and to the value of solar in general, this blog is merely highlighting one interest trend, that given the growth in 3rd party ownership of solar, is something worthy of further discussion and research. The entire study is worth looking at, and the table on the right can be found on page 46.

| What Realtors have to say about the impact Solar leases versus owned systems on market value and marketability: | ||

|

Comments are closed.

|

AuthorMatt Golden, Principal Archives

October 2017

Categories

All

|

RSS Feed

RSS Feed