It seems like a no-brainer. Target homeowners during a transaction and during a period in which they traditionally spend substantially more on home improvements. One NAHB Study showed that a buyer of an existing single-family detached home tends to spend about $4,000 more than a similar non-moving home owner, including $3,600 during the first year.

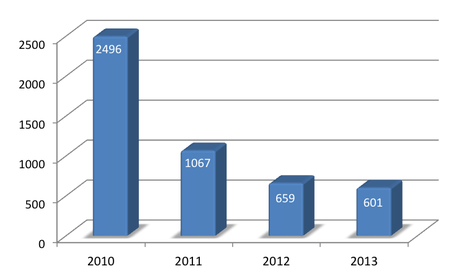

While focusing on a home purchase a trigger for an energy efficiency upgrade seems extremely logical, it has not been working in the market. This “trigger point” continues to be the focus of government programs, whitepapers, and both State and National legislation, yet EEMs have not achieved more than a toe hold in the market, and the numbers continue to fall.

Total US Energy Efficiency Mortgage (EEM) Loans Per Year

1) People buy solutions to problems

Unlike kitchen, bathroom remodels, and new flooring, energy efficiency and comfort are not visible to a homeowner that has not yet paid a bill or spent a cold winter (or hot summer) in their new home. As the trigger to get people to invest in energy efficiency and comfort solutions for their home tends to be based on solving a pain point, it is hard to motivate a new buyer to take action on issues where they have yet to experience the problems.

2) Buying a house is stressful enough

The process of buying a house is full of stressful decisions, complexity, and risk - and for most people constitute their biggest single investment. Adding another moving part to this process, one that will require more inspections and general make transactions take longer is just not a priority for most home buyers.

3) There's no money in EEMs

Nationally, Energy Efficiency Mortgages add and average of only $7,500 for energy efficiency upgrades onto the base mortgage (based on data from HUD). When you consider that time is money, and that the brokers and realtors who are shepherding the transaction through the process get paid when it is completed, there is no wonder we don’t see realtors jumping up and down excited to promote EEMs.

On the typical EEM, realtors make no money, as their commission is based on the sale price, not the added value of the EEM. Realtors make no more money on an EEM than a traditional mortgage yet they incur risk, extra time, and expense.

As usual the answer is simple - follow the money!

RSS Feed

RSS Feed