The Basics

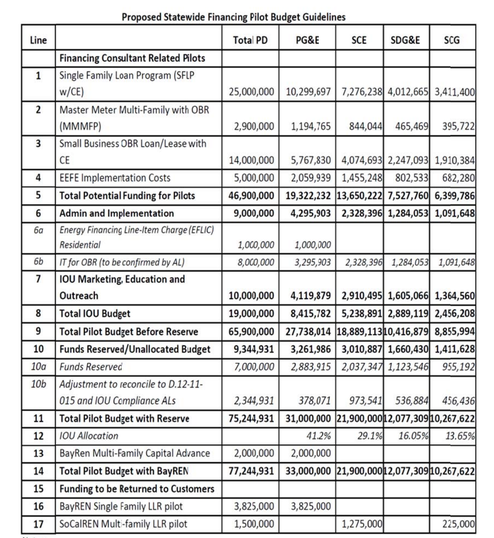

The California Public Utility Commission (CPUC) is allocating $65.9 million to launch implementation of selected pilot programs designed to test market incentives for attracting private capital through investment of limited ratepayer funds.

A core feature of the authorized pilots is the leverage of limited ratepayer Energy Efficiency funds for Credit Enhancements (CE), such as a loan loss reserves, to provide incentives to lenders to extend or improve credit terms for energy efficiency projects. A key objective is to test whether transitional ratepayer support for credit enhancements can lead to self supporting energy efficiency finance programs in the future.

The Decision establishes an administrative hub, identified as the California Hub for Energy Efficiency Financing (CHEEF), created to increase the flow of private capital to energy efficiency projects. The California Alternative Energy & Alternative Transportation Financing Authority (CAEATFA) will assume the CHEEF functions and direct the IOUs and Commission staff to assist CAEATFA with implementation.

Implementation of both the CHEEF, and the financing pilots, will be phased in beginning in the fourth quarter of 2013, and all pilots should be online by mid-2014, due to potential for delays, the pilot period has been extended to include 2015.

Three residential energy efficiency financing pilot programs are approved, all of which have a component to reach low-to-moderate income households currently overlooked by the capital markets. None would permit shut off of electric service as a result of non-payment of energy efficiency financing obligations. One program supports lending to the single family market sector, complemented by another program which allows the loan payment to appear as an itemized charge on the electric bill. A third pilot program targets master-metered multifamily buildings that house primarily low and moderate income households.

The Decision also authorizes three non-residential energy efficiency financing pilot programs, two for small businesses, and expand on-bill utility collection of the monthly finance payments. The On-Bill Repayment (OBR) feature will test whether payment on the utility bill increases debt service performance across market sectors. No “credit enhancements” (i.e., ratepayer funds) are authorized to support OBR financing for medium and large businesses. This decision requires the utilities to develop uniform OBR tariff language that includes transferability of the obligation through written consent (and other mechanisms), and service disconnection for default on the debt obligation.

A cornerstone of the recommended pilot programs is a “credit enhancement” strategy (e.g., loan loss reserve) for residential and non-residential markets in which ratepayer funds are leveraged to achieve more deal flow, primarily through reduced interest rates, during the pilot period. A second critical element is the introduction of a repayment feature on a customer’s utility bill for non-utility Energy Efficiency financing. Significantly, no residential service disconnection is authorized for non-payment of Energy Efficiency loans. A third feature is a database that includes project performance and loan repayment history to inform what hopefully will become new underwriting criteria for the financial industry.

The Commission specifically authorizes two types of Credit Enhancements: Loan Loss Reserve (LLR) and Debt Service Reserve Fund (DSRF).

Highlights of the Implementation Plan, as modified to reflect comments, include the following approximate milestones:

- CAEATFA is fully operational to act as the CHEEF in December 2013

- Two pilots are operational in an early “pre-development’’ phase by December 2013 (EFLIC and MMMF)

- On-Bill Repayment tariff filed by January 2014

- Trust Accounts are established in February 2014

- Credit Enhancement functionality is ready in February 2014

- Two pilots (Single Family and off-bill Non-residential Lease) are operational by March 2014

- Master Servicer begins operations in April 2014

- OBR is launched in July 2014

Eligible Energy Efficiency Measures

There is significant disagreement about whether and how to limit Energy Efficiency financing pilot programs to funding in support of qualified Energy Efficiency projects, identified here as Eligible Energy Efficiency Measures (EEEM). EEEMs are measures that have been approved by the Commission for a Utility’s Energy Efficiency rebate and incentive program, although the customer need not get an incentive or rebate to qualify for the loan. Each utility is directed to make a list of EEEMs publicly available, including on the utility’s website.

The Decision authorized energy efficiency pilot program financing qualifying for CEs must apply a minimum of 70% of the funding to Eligible Energy Efficiency Measures (EEEMs). Therefore, financing eligible for CEs may include funds for non-EEEMs totaling up to 30% of the loan total.

The 70% / 30% ratio of Energy Efficiency measures and non-Energy Efficiency measures also applies to financing which does not rely on ratepayer-funded CEs (e.g., OBR for medium and large businesses). However, a wider range of eligible projects (e.g., demand response, distributed generation) may be included in the 70% eligible Energy Efficiency measures for those pilots. Based on the Decision, it appears that projects that receive no credit enhancements, such as through OBR, will be able to finance projects that consist of only distributed generation or demand responce.

Residential Pilot Programs

The primary goals of the Single Family pilot programs are:

- Increase the volume of Energy Efficiency financing to attract capital providers and attract new market

- Provide a reliable, one-stop mechanism which provides attractive rates and terms for consumers; and

- Have a quick turn-around for payments to contractors.

The fact that the CPUC is not authorizing WHEEL represents a serious disconnect. CA has goals that will cost by their own estimation at least $68 Billion. Of all the proposed financing options, only the WHEEL program, which is a securitization and access to senior capital markets for energy efficiency, has the potential to deliver the volume of capital to CA that is required to hit even a fraction of the CPUC’s goals. By not authorizing this pilot, CA is building on a foundation that from the beginning cannot drive sufficient capital. Learn more about WHEEL.

It is also a little surprising that in this pilot period, which is meant to lay a foundation for goals that may require as much as $4 Billion per year (based on a CPUC estimate) in available financing, the CPUC chose to pilot Loan Loss Reserve approaches that closely mirror existing financing mechanisms that currently exist in CA for single family retrofits - in some cases already administered by CAEATFA. These existing product have not seen significant demand to date, and it seems short sighted to put all of our eggs in this basket. This pilot period was an opportunity to try new ideas and experiment. Doing more of the same and expecting different results seems like a long-shot (Einstein might call it something else).

Energy Financing Line-Item Charge (EFLIC) PILOT

The Decision creates a Pilot for “Line Item Billing” whereby collection of principal and interest payments on customer loans occurs through utility bills. The primary purpose of this sub-pilot is to test the attractiveness of on-bill repayment and its impact on residential loan performance. In this decision, the sub-pilot is identified as the Energy Financing Line-Item Charge (EFLIC).

The Energy Financing Line-Item Charge differs from non-residential OBR in significant ways. The primary differences are that it does not result in utility disconnection for failure to pay the debt charges, nor does it involve an allocation of partial customer payments between utility energy bills and energy improvement finance charges. The loan obligation does not transfer to subsequent owners or occupants.

Also authorized is a pilot targeting master-metered multifamily housing and offers owners repayment on the master utility bill without the risk of service disconnection. Bill neutrality will not be require for this pilot. (This leaves the owner free to size the project and loan to meet their own objectives and cash flow.)

Non-Residential Pilot Programs

The primary goal of the Non-Residential pilot programs is to build the deal flow necessary to test the value of On-Bill Repayment (OBR) as a bridge to overcome traditional lending barriers in these markets.

On-Bill Repayment

The primary goal of the On-Bill Repayment (OBR) pilots is to test whether the combined single bill payment can overcome lending barriers in the non‐residential sector, and attract large pools of accessible private capital to Energy Efficiency markets.

The OBR system is what is often called an open market approach. Project developers, building owners, and investors can agree to terms on private sources of financing (can include loans, leases, energy service agreements (ESAs), or other structures). By attaching the payment to the meter as a rate tariff, the premise is that this creates a significant credit enhancement without the need for public investment.

OBR, as authorized here, will have two applications: with CEs for small business Energy Efficiency financing and leases, and without CEs for all sized businesses, primarily medium and large-sized non-residential customers.

Three non‐residential OBR pilot programs are authorized in this decision. Two apply credit enhancement and target Small Businesses: one for financing to support Energy Efficiency improvements and one to support Energy Efficiency equipment leasing. The third pilot would expand use of OBR without any CEs to Energy Efficiency financing incurred by any size business using CAEATFA ‐ administered financing products.

The authorized OBR pilot feature discussed herein will be offered only to non-residential customers, and no prohibition exists against disconnection of a non-residential utility customer for nonpayment of a third party change. The Decision requires that the IOUs use the same shut‐off protocols in place for the OBF program for the non‐residential OBR program.

The Decision concludes that written consent should be part of the OBR tariff in order to achieve transferability. Specifically, property owners and landlords that initially commit to the Energy Efficiency financing and OBR program (“current landlord”) and all of the current landlord’s tenants responsible for repayment under the OBR program (“current tenants”) should be required to give their written consent to abide by the terms and obligations of the OBR program.

The fact that OBR will not survive foreclosure is likely a major problem for lenders, as this survivability is one of the key Credit Enhancements that makes OBR so potentially game changing. There is a serious concern that this issue may in fact be a serious drag on the program. EDF recently laid out these concerns in the blog: On-Bill Repayment in California: A Step Forward and a Missed Opportunity

The 70% / 30% ratio for EEEMs / non-EEEMS applies to all OBR pilots, with one exception. For OBR without CEs, the 70% eligible Energy Efficiency measures may include distributed generation and demand response since no ratepayer funds are involved in the loans. CAEATFA has reasonable flexibility, through its rulemaking, to develop basic minimum standards for financing terms and underwriting criteria, consistent with this decision.

California Hub for Energy Efficiency Financing (CHEEF)

CHEEF, is designed to act as a facilitator to allow for the easy flow of cash, information and data, among Investor Owned Utilities, financial institutions, the Commission and others. CHEEF will be run by the California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA).

Master Servicer

CAEATFA is encouraged to contract with a Master Servicer (MS), as its agent, to provide CE fund flow management, oversight, instructions, and reporting. The Decision finds it reasonable for CAEATFA, as CHEEF, to hire an MS through a competitive solicitation. According to the Implementation Plan, CAEATFA expects to complete the RFP process and award the MS contract by January 2014.

If CAEATFA cannot perform the CHEEF role by January 15, 2014, the record in the consolidated proceedings should be reopened to determine another entity to effectively assume the CHEEF role.

The Energy Finance Database

The Energy Efficiency Finance database has the objective of providing sufficient accessible data to see whether Energy Efficiency financing outperforms non-energy debt obligations. The database should be housed and managed by the CHEEF for the benefit of ratepayers.

CAEATFA would need to develop and manage an RFP process for the Energy Finance Database, competitively select a Data Manager, and obtain final approval of the Data Manager contract by February 2014.

No later than November 30, 2013, each Investor Owned Utility shall provide the Commission with a breakdown of utility bill payment history segregated by minimum customer classes of Residential, Commercial and Industrial, for a period of seven to ten years (from December 31, 2012) as identified by the IOU above. The data should be broken down monthly, if available.

The data shall include, to the extent available through reasonable efforts, what percentage of customers within a customer class received, monthly or annually, late notices, shutoff notices, and service disconnection. Finally, annual write-offs per customer class should be expressed as a percent of customer class revenue, no later than January 31, 2014

Where exactly is all the money going?

RSS Feed

RSS Feed